Restaurant equipment depreciation calculator

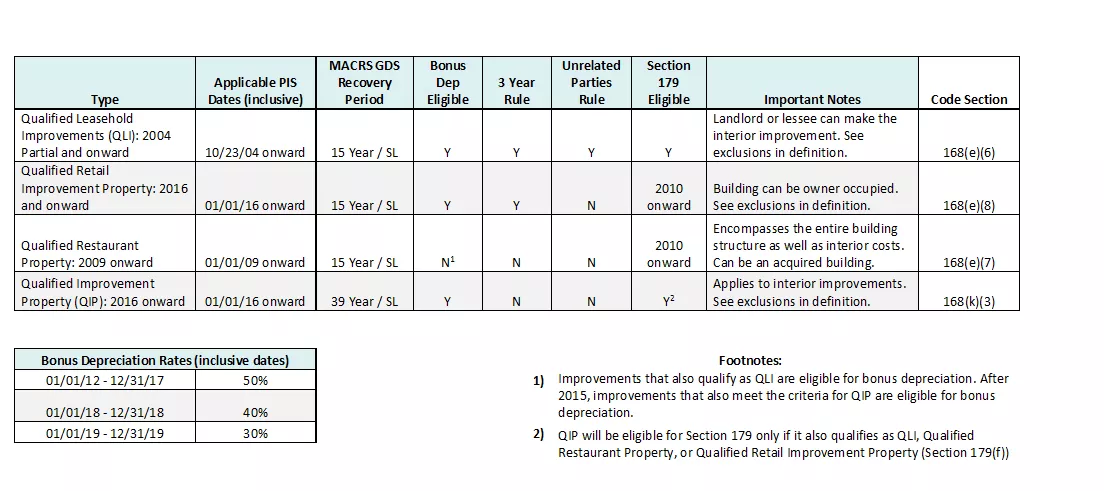

Certain property with a long production period. For these assets you first fill out Form 4562.

Costs And Benefits Of Restaurant Equipment Leasing

Food Truck Turn long lines into large profits with a fast and reliable POS for food trucks.

. Special depreciation rules apply to listed. Receive payment for certain services. Display Characters X Display Lines - 26 x 10.

You need to rely on your tax records when calculating your allowable expenses the figures will be unique to your business. Thats the net income that a restaurant can expect to earn on a consistent basis before depreciation. Whether you are protecting your businesss future with key person insurance exploring the value of a buy-sell agreement looking to understand how a business transfer works considering help with retirement plans or offering your employees and yourself convenient access to important life insurance protection through.

GDS using 200 declining balance. Restaurant Cash Flow Statement. Investing Managing Credit and Managing Risk.

Full Service Restaurant Turn more tables upsell with ease and streamline service with a powerful system built for FSRs. A capital lease referred to as a finance lease under ASC 842 and IFRS 16 is a lease that has the characteristics of an owned assetIn accounting for a capital lease the lessee records the leased asset as if he or she purchased the leased asset using funding provided by the lessor. A fixed cost is a cost that does not change with an increase or decrease in the amount of goods or services produced or sold.

Decimal Function - Yes - Switch Key - Yes. If you take a section 179 deduction explained in chapter 8 under Depreciation for an asset and before the end of the assets recovery period the percentage of business use drops to 50. Piracy refers to the unauthorized duplication of copyrighted content that is then sold at substantially lower prices in the grey market.

Calculate your equipment value now. Family Style Turn more tables and delight guests with a POS built for family style restaurants. It can be physical or in virtual or cyber form.

For more information on excise taxes see Pub. This calculator computes the residual value to satisfy a known payment amount cost and useful life in years. A product is the item offered for sale.

Power Sources - Battery. A product can be a service or an item. These properties might also qualify for a special depreciation allowance.

Fractiondecimal Conversions - No. The ease of access to technology has meant that over the years piracy has become more rampant. Here are the key terms to understand.

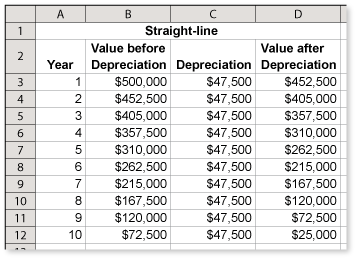

Equipment value Interest Rate There are three depreciation formulas used to value equipment but the annual straight line depreciation method is the mostEach rate covers all. As a refresher an operating lease functions much like a. The law allows businesses to depreciateor gradually deduct the cost of assets such as equipment fixtures furniture etc that will last more than one year.

The price that can be charged depends on the market the quality the marketing and the segment that is targeted. All of your efforts in understanding restaurant financials are captured in the details of the PL statement. Fraction Calculations - Yes.

What is a capitalfinance lease. She plans to use the straight-line method to depreciate the equipment over 5 years. Its a case of adding up your expenses from your bills and receipts so its important that you keep them all otherwise you might miss out on a claim.

MACRS depreciation schedule gives you 3 methods under the GDS and 1 depreciation method under the ADS. Number Of Display Digits - 10. Each product has a useful life.

Liliana spends 20000 cash on a piece of equipment for use in her restaurant. Percent Keys - Yes. Depreciation and Section 179 expense deduction.

Depreciation and Amortization and enter the result on Schedule C. Meaning if you default on your payments the lender has the authority to seize your equipment to pay off the loan. Using a restaurants maintainable cash flow and taking into consideration how comparable restaurants operate you can determine the cap rate also called earnings multiples.

Depreciation rules for listed property. Product Type - Calculators-Graphing. Memory - 21KB RAM.

This webinar provides attendees with new and improved resources for teaching the following topics. For the lenders protection they may require a lien on the equipment to use as collateral. Qualified Liberty Zone property placed in service before Jan.

Fixed costs are expenses that have to be paid by a company. Equipment financing is a loan that is used to acquire the equipment you need to run your business. Cash flow is about survival.

She expects it to have no value at the end of. Currency Exchange Function - No. KBKG goes beyond a traditional Cost Segregation study and will also separate all of the different building structural components such as the roof windows or HVAC units so when they are replaced a loss.

Qualified GO Zone property placed in service before Dec. We would like to show you a description here but the site wont allow us. It is pre-populated with expense categories common to many small businesses and home-based businesses so it can be very useful in helping you identify all of your start up costs including many you may not have considered.

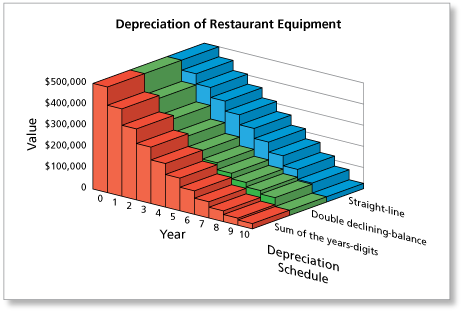

Depreciation of Fixed Assets. This tax depreciation method gives you a significant tax deduction in the earliest years. The 200 or double-declining depreciation simply means that the.

For example certain electrical outlets that are dedicated to equipment such as appliances or computers should be depreciated over 5 years. Self-employed expenses calculator. Use various kinds of equipment facilities or products.

These MACRS depreciation methods include. Your cash flow is literally how much cash you have on hand to pay bills buy equipment and fix anything that needs fixing in a pinch. Brewery Increase beer sales and reduce spillage with an intuitive POS.

Using This Business Valuation Calculator. How does it work. Display Notation - Numeric.

This Excel workbook will help you put together an estimate of costs and funding required to start your business. Display Types - LCD. For example CD writers are available off the shelf at very low prices making music piracy a simple affair.

Every product is made at a cost and each is sold at a price. Prepare journal entries to record each of the following events.

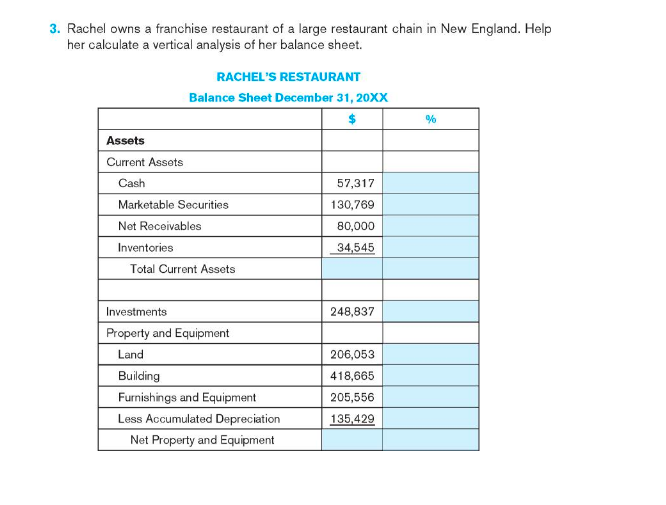

Solved 3 Rachel Owns A Franchise Restaurant Of A Large Chegg Com

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Quick Tips For Calculating Depreciation And Knowing What Qualifies Smith And Howard Cpa

Math You 4 4 Depreciation Page 192

Do High End Appliances Depreciate Wolf Subzero Miele Gambrick

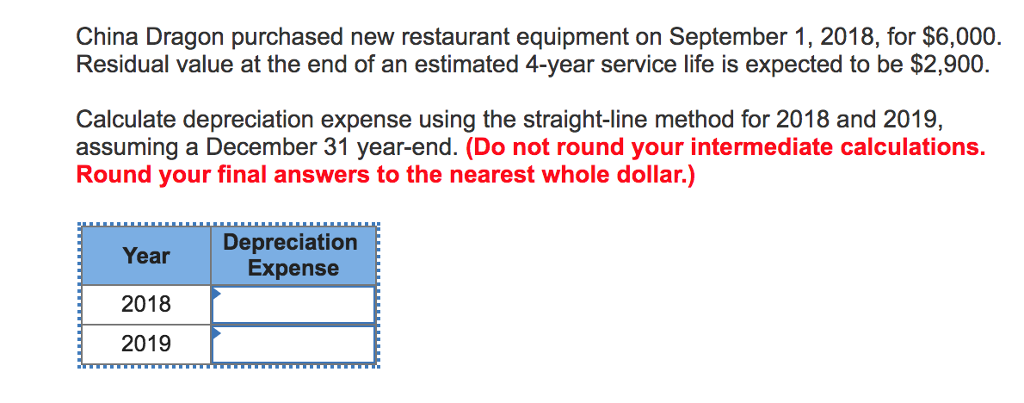

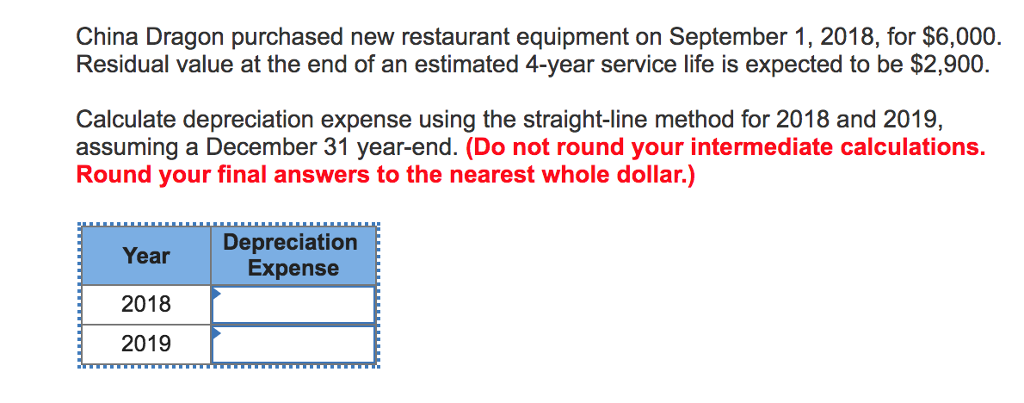

Solved China Dragon Purchased New Restaurant Equipment On Chegg Com

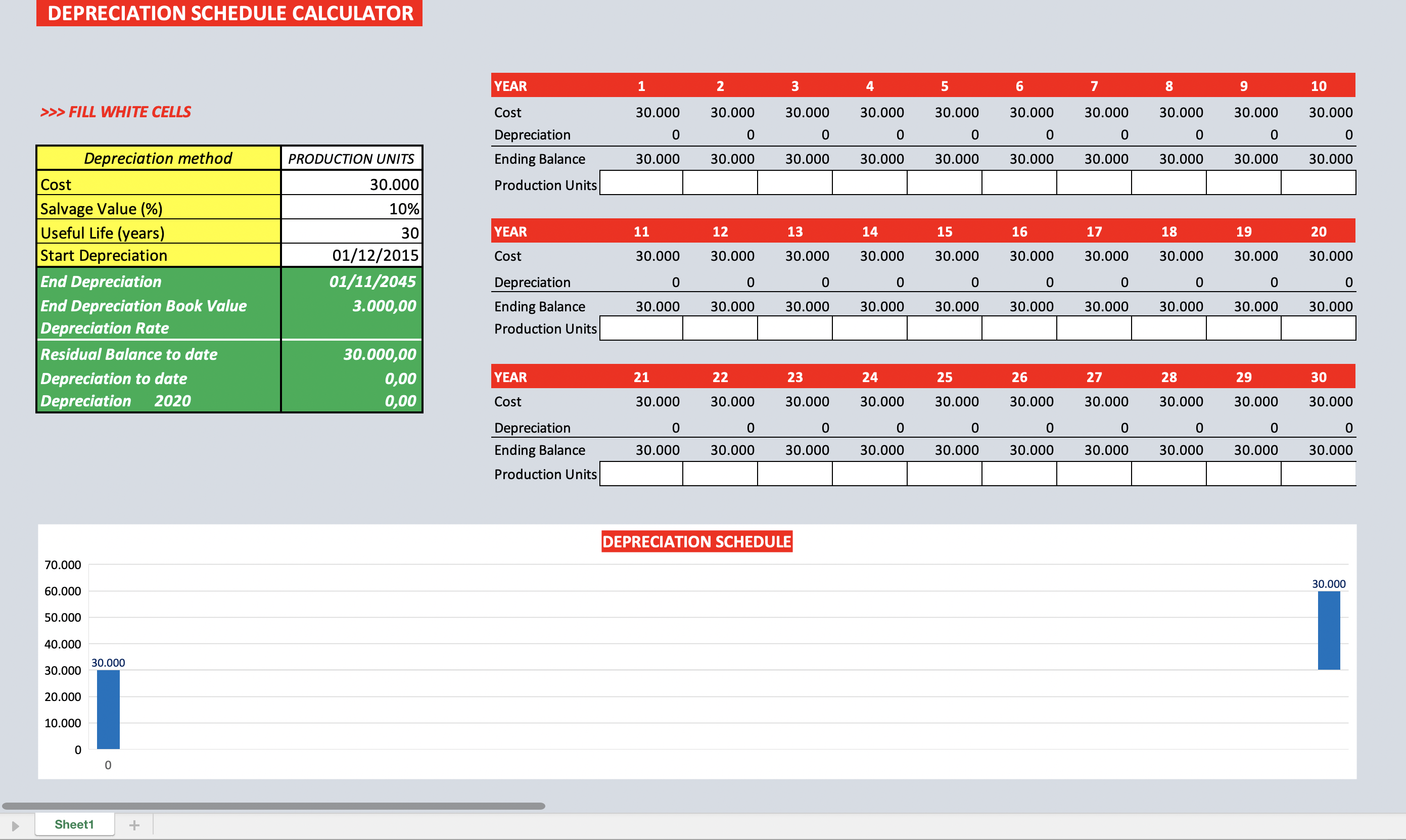

Depreciation Schedule Calculator Eloquens

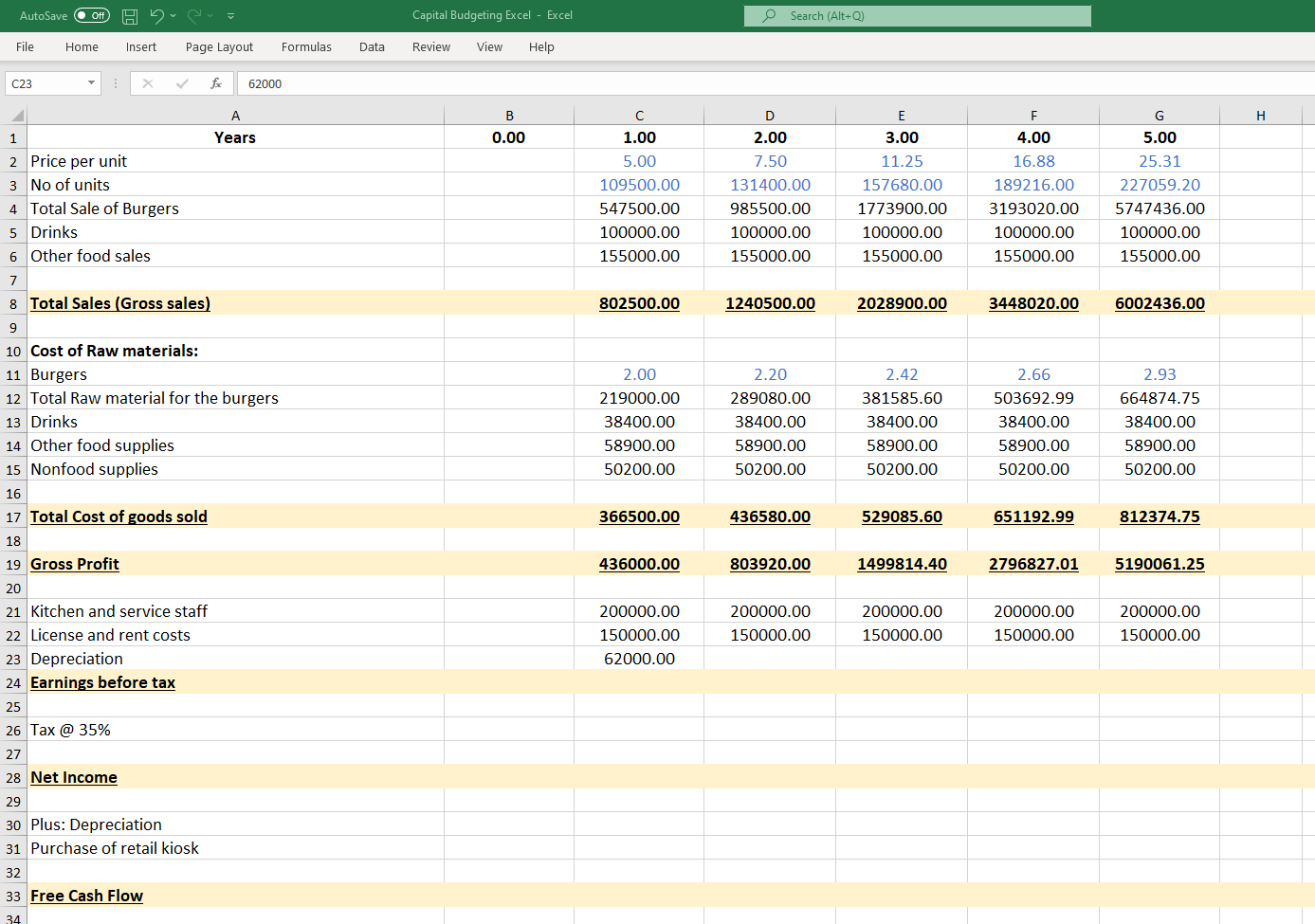

Solved How To Calculate Depreciation Purchase Of Retail Chegg Com

What Is Equipment Depreciation And How Do I Calculate It Ridgestone Capital

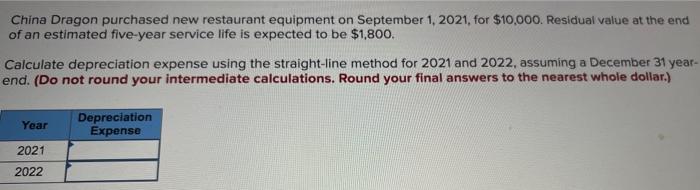

Solved China Dragon Purchased New Restaurant Equipment On Chegg Com

Hvs Food Beverage Hospitality Report

How To Calculate Depreciation Expense For Business

Restaurant Depreciation Worksheet Template Google Docs Google Sheets Excel Word Apple Numbers Apple Pages Template Net

Lesson 5 Determining The Economic Life Average Service Life Of Equipment And Fixtures Valuation Of Personal Property And Fixtures

Hvs Food Beverage Hospitality Report

Math You 4 4 Depreciation Page 192

Bea Depreciation Rates By As Sets Download Table