Vt payroll calculator

Free Unbiased Reviews Top Picks. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is.

Free Vermont Payroll Calculator 2022 Vt Tax Rates Onpay

Get Started With ADP Payroll.

. Payroll department responsibilities include but are. Vermont payroll calculators Latest insights The Green Mountain State has a progressive income tax system where the income taxes are some of the highest in the United States. Additional services and employee support includes.

Figure out your filing status work out your adjusted gross income. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Vermont. The Total Compensation Calculator is used to estimate the pay and benefits which make up the total compensation package for a given position.

Vermont Paycheck Calculator Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Vermont Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. The results are broken up into three sections.

Enter your info to see your. Calculating your Vermont state income tax is similar to the steps we listed on our Federal paycheck calculator. Vermont Paycheck Calculator Use ADPs Vermont Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Ad Get ready to take control of your companys finances with LP Accounting. Ad Get ready to take control of your companys finances with LP Accounting. Paycheck Results is your gross pay and.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Its important to understand your total. The Vermont Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Vermont State.

Get ready to take control of your companys finances Financials life goals. For example if an employee receives 500 in take-home pay this calculator can be. Ad Process Payroll Faster Easier With ADP Payroll.

The Payroll department is responsible for processing salary wage fellowship and special payments for all Virginia Tech employees. Well do the math for youall you need to do is enter. Discover ADP Payroll Benefits Insurance Time Talent HR More.

VTHR is the secure online system for managing employee data and processing payroll. Get Started With ADP Payroll. Vermont Vermont Hourly Paycheck Calculator Results Below are your Vermont salary paycheck results.

Discover ADP Payroll Benefits Insurance Time Talent HR More. As a State of. Simply enter their federal and state W-4 information as.

Use this Vermont gross pay calculator to gross up wages based on net pay. The state income tax rate in Vermont is progressive and ranges from 335 to 875 while federal income tax rates range from 10 to 37 depending on your income. Ad Compare This Years Top 5 Free Payroll Software.

Ad Process Payroll Faster Easier With ADP Payroll. Free Unbiased Reviews Top Picks. Supports hourly salary income and multiple pay frequencies.

Welcome to the State of Vermonts VTHR Human Resource information system. Ad Compare This Years Top 5 Free Payroll Software. Vermont Paycheck Calculator - SmartAsset SmartAssets Vermont paycheck calculator shows your hourly and salary income after federal state and local taxes.

Below are your Vermont salary paycheck results. DHR-VTHR_NetPay_Calculatorxlsx 1772 KB File Format Spreadsheet Description The Net Pay Calculator is used to figure out what your pay check will be based on. Just enter the wages tax withholdings and.

Get ready to take control of your companys finances Financials life goals. The results are broken up into three sections. All Services Backed by Tax Guarantee.

Additionally Payroll validates employee pay for compliance with Federal and State regulations and Collective Bargaining Agreements. Calculate your Vermont net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Vermont. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Vermont.

![]()

Free Vermont Payroll Calculator 2022 Vt Tax Rates Onpay

Nanny Tax Payroll Calculator Gtm Payroll Services

Vermont Sales Tax Small Business Guide Truic

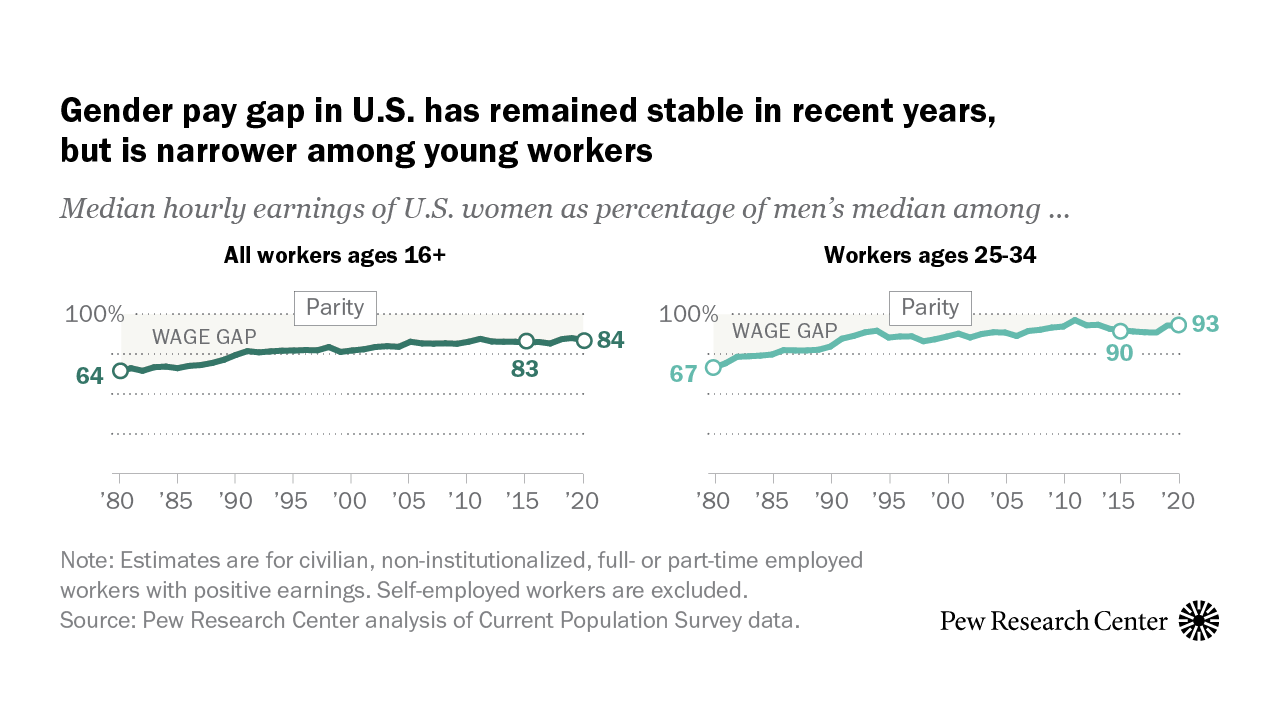

Gender Pay Gap In U S Held Steady In 2020 Pew Research Center

New York Hourly Paycheck Calculator Gusto

Deadweight Loss Formula How To Calculate Deadweight Loss

Employer Payroll Tax Calculator Incfile Com

Vermont Paycheck Calculator Smartasset

![]()

Free Vermont Payroll Calculator 2022 Vt Tax Rates Onpay

4 Ways To Calculate Porosity Wikihow

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

Vermont Paycheck Calculator Smartasset

Payroll Tax Calculator For Employers Gusto

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Equivalent Salary Calculator By City Neil Kakkar

Nanny Tax Payroll Calculator Gtm Payroll Services