19+ rhode island paycheck calculator

Average value over interval calculator. Discover a wealth of knowledge to help you tackle payroll HR and benefits and compliance.

Dv8 For Jeep Roof Rack Fo 07 18 For Jeep Jk 4 Dr 18 Jl 2 Dr 19 Gladiator Jt Ebay

Overview of Rhode Island Taxes.

. Calculate your Rhode Island net pay or take home pay by entering your per-period or annual salary along with the pertinent federal. Calculating paychecks and need some help. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Rhode Island.

Federal Paycheck Calculator Calculate your take home pay after federal state local taxes Updated for 2022 tax year on Aug 02 2022. This Rhode Island hourly paycheck. Take home pay is calculated based on hourly pay rates that you enter along with the pertinent Federal State and local W-4.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Rhode Island Hourly Payroll Calculator - RI Paycheck Calculator. Luteal phase length calculator.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Rhode Island tax year starts from July 01 the year before to June 30 the current year. The tax rates vary by income level but are the same for all taxpayers.

Simply enter their federal and state W-4 information. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Payroll pay salary pay check.

Back to Payroll Calculator Menu 2013 Rhode Island Paycheck Calculator - Rhode Island Payroll Calculators - Use as often as you need its free. COVID-19 Employer Toolkit Diversity Equity and Inclusion Toolkit. Rhode Island has a progressive state income tax system with three tax brackets.

Net income Payroll tax rate Payroll tax. If youre a new employer congratulations by the way you. This free easy to use payroll calculator will calculate your take home pay.

Employers pay between 099 and 959 on the first 24600 in wages paid to each employee in a calendar year. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Rhode Island. Rhode Island Salary Paycheck Calculator.

Supports hourly salary income and multiple pay frequencies.

Kerry Manton Author At Chiene Tait

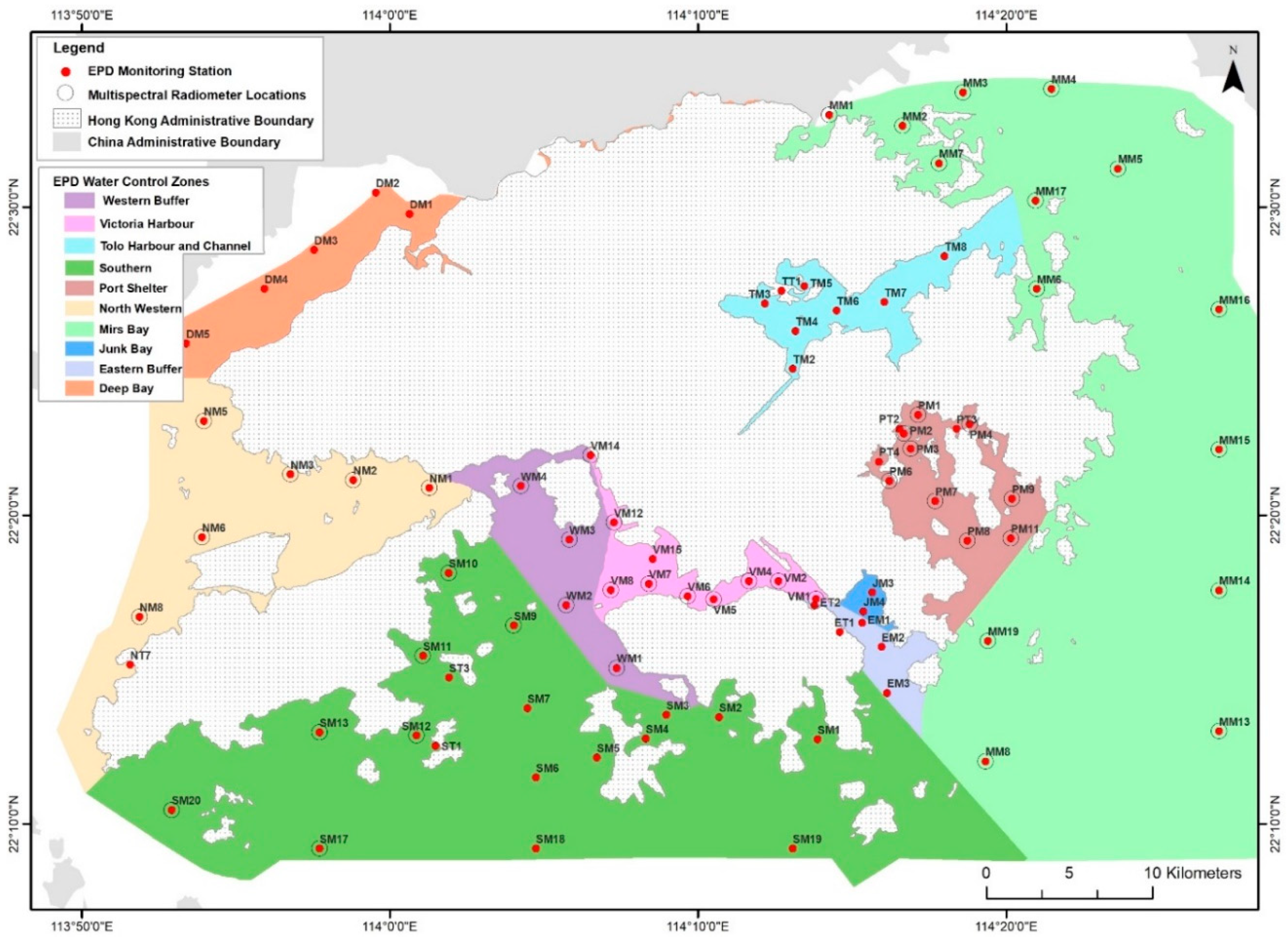

Remote Sensing Free Full Text Comparison Of Machine Learning Algorithms For Retrieval Of Water Quality Indicators In Case Ii Waters A Case Study Of Hong Kong Html

Draft Local Cycling And Walking Infrastructure Plan Lcwip Fiets Let S Cycle Like The Dutch

Paycheck Calculator Template Download Printable Pdf Templateroller

So Rhode Island January 2021 By Providence Media Issuu

Third Rhode Apartments 230 Rhode Island Ave Ne Washington Dc Rentcafe

Here S How Much Money You Take Home From A 75 000 Salary

Rhode Island Salary Paycheck Calculator Gusto

Special Education Remote Learning Information Contacts Resources Links New York Lawyers For The Public Interest

18799 State Highway 99s Ada Ok 74820 Realtor Com

S4wm0xknhzta7m

Rhode Island Paycheck Calculator Smartasset

Eds Community Of Practice Enhance Digital Teaching Platform

Rhode Island Wage Calculator Minimum Wage Org

Rhode Island Income Tax Calculator Smartasset

Adult Education Budget Funding And Performance Management Rules 2022 To 2023 Gov Uk

Here S How Much Money You Take Home From A 75 000 Salary